Try working with high-frequency market data including L2 order-book easily and for free. All you need is pip install lakeapi and a jupyter notebook. If you don’t have Python and Jupyter installed on your computer, check out our online notebook 🕵️.

Example

Why is order book essential?

Short-term and mid-term strategies are appreciated for higher returns and faster strategy validation compared to long-term trading. For those strategies, you need detailed market microstructure data including individual trades and order book.

Order book data are needed for precise backtests, execution simulation, (statistical) arbitrage strategies or market making. Knowing the best price levels or available liquidity allows you to precisely determine for which prices are you able to trade, what liquidity is available in the order book or how much slippage will occur on trade. In the end, you are able to conduct precise backtests, that will closely match real execution.

How do the order book data look like? Check out the data schemata and access.

Available data

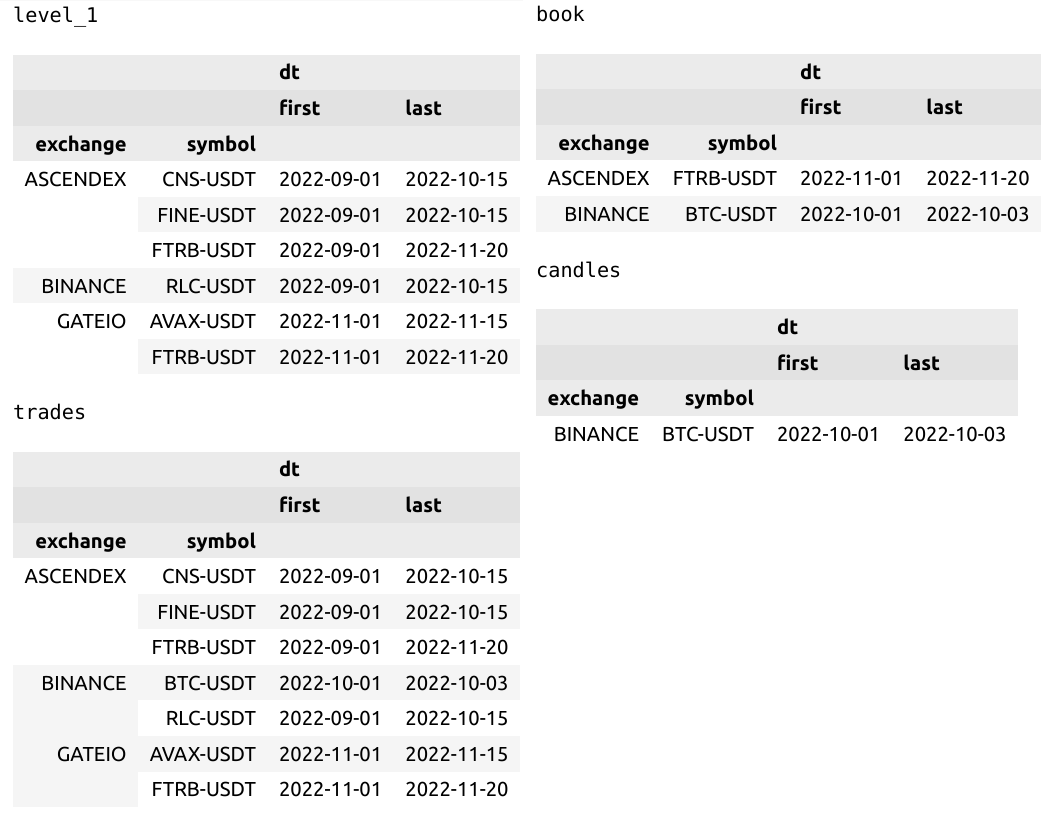

We have four data types available with a combined coverage of around a year of data.

Subscribe to get all data

Want to become more efficient at creating profitable trading strategies and alpha generation? Check our convenient pricing below ↓.

Market data

- Subscribe now,

start your research in 3 minutes.

Existing subscribers

- Upgrade, pause or cancel

your subscription any time.